Top 5 Retirement Challenges for Women

Top 5 Retirement Challenges for Women

- Women usually live longer than men but tend to save less for retirement.

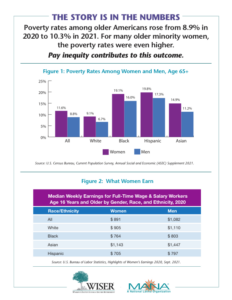

- Women make 82 cents to every dollar a man earns.

- Women are more likely to work part-time jobs without access to workplace savings plans.

- Women are still the primary caregivers, often leaving jobs to care for family members.

- Older women rely on Social Security; for many it is their only source of income.

WISER’s goal is to help women make the best financial decisions they can by providing the information and resources needed to take action and create a secure financial future.

LEARN MORE ABOUT WISER • SEE THE WHY WOMEN PAGE

The 2023 iOme Challenge is Underway!

The iOme (I OWE ME) Challenge is a national student competition that encourages students to analyze the current state of retirement policy in the U.S. and propose viable policy solutions to meet the needs of their generation.

The iOme (I OWE ME) Challenge is a national student competition that encourages students to analyze the current state of retirement policy in the U.S. and propose viable policy solutions to meet the needs of their generation.

Each year, student teams from across the U.S. respond to the annual iOme Challenge question in a 5,000-word essay. The winning team shares a cash prize of $5,000 and an invitation to Washington, DC to present their submission at a WISER forum and discuss it with public policymakers.

Read this year’s Challenge question and register your team today!

Deadline for submissions is May 14, 2023.

LEARN MORE ABOUT THE IOME CHALLENGE

The Benefit U Project

The Benefit U Project

The goal of the Benefit U project is to better understand independent workers’ needs and priorities and to test an easy-to-use fintech solution to meet their benefit needs.

With support from the Financial Health Network, WISER has built upon the Benefit U Project’s work and piloted an approach to expand financial education and access to benefits while also leveraging the reach of local nonprofits that serve independent workers in specific sectors.

Benefit U – Building Portable Benefits for Independent Workers: A Fintech/Nonprofit Partnership in Appalachia Summary Report, September 2021

MORE ABOUT THE ‘BENEFIT U’ PROJECT • MORE WISER RESEARCH

WISER 2023 Events

WISER 2023 Events

WISER’s Annual Forum featuring the iOme Challenge

Intergenerational Perspective on Retirement Solutions

June 2023

Click below to see more upcoming events featuring WISER.

See more upcoming events featuring WISER.

Loss of a spouse can result in financial vulnerability. Life insurance can help you avoid a financial impact. For more information about life insurance, see WISER’s factsheet: Are You Sure About Life Insurance?

Loss of a spouse can result in financial vulnerability. Life insurance can help you avoid a financial impact. For more information about life insurance, see WISER’s factsheet: Are You Sure About Life Insurance?

WISER’s guide, Financial Steps for Caregivers/

WISER’s guide, Financial Steps for Caregivers/

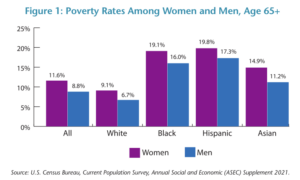

WISER and partners, the National Caucus and Center on Black Aging, Inc., and MANA, A National Latina Organization, spotlight challenges that put older minority women at risk for poverty in old age and highlight opportunities for change. Report:

WISER and partners, the National Caucus and Center on Black Aging, Inc., and MANA, A National Latina Organization, spotlight challenges that put older minority women at risk for poverty in old age and highlight opportunities for change. Report:  A recent study, ‘Women Have Made Big Strides In Retirement Readiness’ has some good news but it’s “A snapshot of women with college education and careers,” according to WISER’s Cindy Hounsell: “The extent to which women are prepared

A recent study, ‘Women Have Made Big Strides In Retirement Readiness’ has some good news but it’s “A snapshot of women with college education and careers,” according to WISER’s Cindy Hounsell: “The extent to which women are prepared  WISER is 2023 Award Winner of the American Society on Aging’s Advancing Economic Security for Older Adults Award! Awardees were nominated and selected because of their tireless work and unwavering dedication to the field of aging. WISER President Cindy Hounsell will accept the award at the ASA

WISER is 2023 Award Winner of the American Society on Aging’s Advancing Economic Security for Older Adults Award! Awardees were nominated and selected because of their tireless work and unwavering dedication to the field of aging. WISER President Cindy Hounsell will accept the award at the ASA

The Consumer Financial Protection Bureau has several reverse mortgage resources for prospective and current borrowers and their families:

The Consumer Financial Protection Bureau has several reverse mortgage resources for prospective and current borrowers and their families:

Top 5 Retirement Challenges for Women

Top 5 Retirement Challenges for Women The iOme (I OWE ME) Challenge is a national student competition that encourages students to analyze the current state of retirement policy in the U.S. and propose viable policy solutions to meet the needs of their generation.

The iOme (I OWE ME) Challenge is a national student competition that encourages students to analyze the current state of retirement policy in the U.S. and propose viable policy solutions to meet the needs of their generation. The Benefit U Project

The Benefit U Project  WISER 2023 Events

WISER 2023 Events