The US Department of Veterans Affairs helps veterans and their families cope with financial challenges by providing supplemental income through the Veterans Pension benefit. Veterans Pension is a tax-free monetary benefit payable to low-income wartime Veterans.

- Improved Disability Pension – is the pension program for veterans, which is available for low-income veterans that meet certain criteria.

- Improved Death Pension – is the pension program for surviving spouses and dependent children.

For Veterans – The VA Pension:

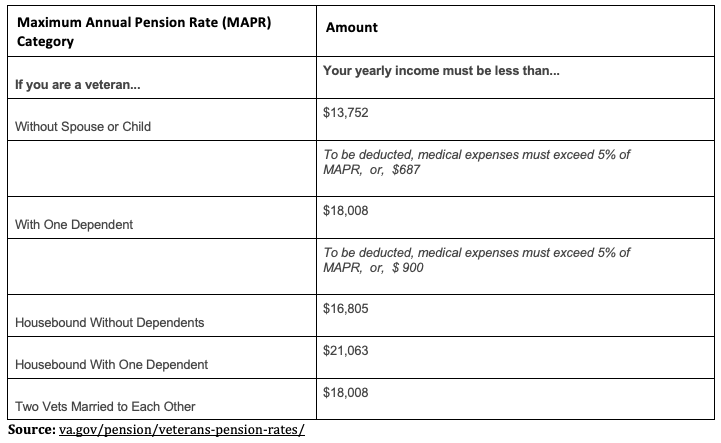

Also called the “improved disability pension,” this benefit provides monthly payments to veterans who meet low-income qualifications. Each veteran’s benefit amount is calculated using the Maximum Annual Benefit, which sets an upper limit on annual income. The veteran’s monthly benefit is the difference between this maximum annual benefit and the veteran’s countable income, spread out over the year. The maximum annual benefit is calculated depending on whether the veteran has a spouse, dependent child(ren) and how much aid the veteran needs. It is adjusted each year, like Social Security benefits, using a COLA (cost of living adjustment).

Eligibility:

To receive the Improved Disability Pension, the veteran cannot have left service under “dishonorable” conditions. In addition: he/she must have served in the active military under at least one of these conditions:

- for at least 90 days during a wartime period

- during a war but was released due to disability from service

- for 90 or more days which started or ended during a wartime period, or

- for 90 days during multiple periods of service during at least one period of war

The veteran’s annual countable income must not be above the maximum annual benefit amount, nor can he/she have a high enough net worth that it could be used instead of the benefit for assistance. Social Security benefits are included in a veteran’s annual countable income, but Supplemental Security Income is not included.

As of 2001, all veterans age 65 and over who meet the above income, combat, and net worth criteria are eligible for the Improved Disability Pension benefit, regardless of disability status.

VA Pension Benefit Table for 2020:

For Surviving Spouses and Dependent Children – The Improved Death Pension Benefit:

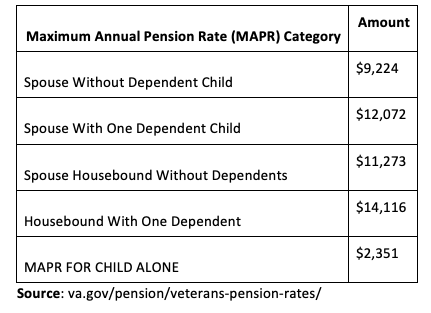

This benefit provides monthly payments to remarried surviving spouses who are not remarried and unmarried dependent children of wartime veterans who died for reasons other than disability from service. The COLA is also applied to maximum annual benefit amounts for spouses and dependent children. The maximum annual benefit is higher for spouses that need aid and attendance and for those that are confined to their houses. Funds from the veteran’s life insurance policy are not included in the spouse’s or child’s countable income.

Eligibility:

The veteran of the spouse must meet the service requirements listed above for the Improved Disability Pension. For this benefit, however, a veteran who served for two years and died in service (but not in the line of duty) is also eligible.

The spouse must not be remarried and must have been married to the veteran for at least one year (or for any amount of time if they had a child.) There are specific dates for marriage eligibility for veterans of specific wars. They must have gotten married before:

- January 1, 1957 for veterans of World War II

- February 1, 1965 for veterans of the Korean conflict

- May 8, 1985 for veterans of the Vietnam era

- January 1, 2001 for veterans of the Persian Gulf War

Improved Death Pension Rate Table for 2020:

Sources:

U.S. Department of Veteran Affairs benefits.va.gov/pension