How to Find a Financial Planner

Many people learn about financial planning by reading. They cull through the financial pages in newspapers or online and read financial magazines and books. But

Spousal IRAs

What is it? A spousal IRA is a type of individual retirement account that allows a working spouse to contribute to a non-earning spouse’s retirement

Traditional Individual Retirement Accounts (IRAs)

An Individual Retirement Account or IRA provides a convenient way for all working people to save for their retirement. A traditional IRA is a tax-deferred

Legal Agreements for Families and Caregivers

There are an estimated 53 million adult caregivers in the United States and nearly one in five (19%) are providing unpaid care to an adult

Family Financial Planning for Your Spouse

As a caregiver, you may be responsible for communicating your spouse’s care and finances with family and friends involved. Here are some topics to remember as you navigate any financial discussions that involve loved ones.

- Talk to your family members about the various costs involved in your providing care to a family member.

- Depending on the circumstances, you may be able to be paid for being a family caregiver if you are caring for a U.S. military veteran or for someone eligible for Medicaid. Read AARP’s summary (also available in Spanish) to see if your caregiving situation qualifies.

- Keep in mind that you may need to hire services for your spouse, such as transportation services, home health aides, or visiting nurses. In addition, you may need to make some modifications to your home to accommodate your loved one, such as bathroom grab bars, a hospital bed on the first floor, or a ramp. The websites Homemods.org and Caregiverstress.com have ideas and prices for calculating such costs.

- If you are providing most of the care, consider asking your family to pay you as an independent contractor. If you are paid, you can set up a small-employer type pension plan, such as a Simplified Employee Pension (SEP).

- If you don’t have a workplace retirement plan or a SEP, open an Individual Retirement Account (IRA).

- Take steps to alleviate the financial burdens on yourself by accessing resources to assist the person you care for.

- 1 in 5 caregivers experience short and long-term financial strain and many experience strain such as bankruptcy while caring for a loved one. Read caregiver tips here and here on how to manage your finances to avoid the risk of bankruptcy (tips also available in Spanish).

Legal Agreements for Families and Caregivers

For both financial and practical reasons, an increasing number of families are turning to “personal care agreements” to help manage caregiving responsibilities. These are formal contracts that state what care is to be provided and how much the caregiver will be compensated. The contract can be used whether or not the caregiver is a family member. These agreements make the care and payment clear for the caregiver, the recipient, and also for other family members. It can help avoid family conflicts about who will provide care and how much they will be paid. For this reason, the agreement should be discussed with other family members to resolve any concerns before it is drafted.

Because these agreements are formal contracts, it is important to understand what needs to be included. A personal care agreement that involves paying a person for caregiving services should be in writing and be for payments provided in the future (not services already performed). The amount of compensation provided must also be reasonable, meaning it should be similar to what you would typically be charged in your state or geographic area for similar services.

A personal care agreement should also include:

- Date care begins

- Detailed description of services

- How often services will be provided (and allow for flexibility with language such as “no less than 20 hours a week” or “up to 80 hours a month”)

- How much and when the caregiver will be compensated (i.e. weekly, monthly)

- How long the agreement is in effect

- Location where services will be provided

- A statement that the terms of the agreement can be modified by mutual agreement (in writing) of the parties involved

- Signatures by the parties and date agreement was signed

More family care resources are available through the Family Care Navigator (also available in Spanish).

Search the National Academy of Elder Law Attorneys (NAELA) to find lawyers who specialize in elder care. You can search by location, practice area, and language spoken.

For a care agreement example, go to the website for Maine’s Department of Health and Human Services, Office for Family Independence.

Guides for “Managing Someone Else’s Money”

The “Managing Someone Else’s Money” guides can help you understand your role as a financial caregiver, also called a fiduciary. Each guide explains your responsibilities

Monthly Budget Worksheet

Taking the time to understand where your money goes can make a big difference in your financial situation. This monthly budget worksheet can help you

Creating a Household Budget

Caregiving can involve increasing household and medical expenses depending on the care your child needs. Small expenses add up quickly and could prevent you from saving enough for your own retirement.

Especially if you are considering reducing your hours at work or quitting a job, a household budget is essential. It will help you decide how to adjust your lifestyle and expenses depending on your individual expenses and what you think your spouse will need.

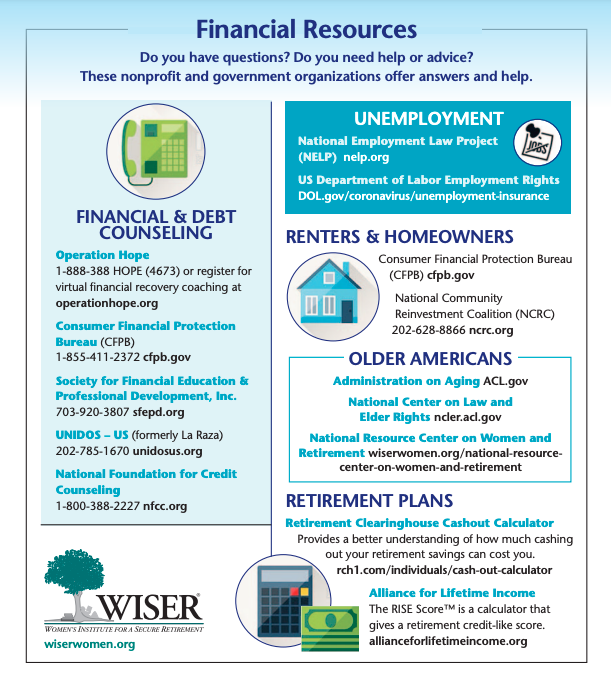

As a caregiver, you may also help manage your love one’s budget and finances. Keeping careful track of spending is a way to protect yourself from false allegations of financial exploitation. It can also prevent future family conflicts over what was spent and why. The Consumer Financial Protection Bureau has Managing Someone Else’s Money guidebooks that can also help.

- Buy a small notebook and take it with you everywhere you go for one month. Write down everything you spend money on, from the smallest “odds and ends” to larger purchases.

- After a few weeks, put your expenses into categories, like food, transportation, and clothing. You may be surprised, for example, how much you spend on food when eating out.

- Make a list of bills you have to pay on a regular basis like car insurance, rent or mortgage payments, dental checkups, and gifts.

- Study your credit card statements and bank statements to make sure you have included (accounted for) everything. Make sure you have included time-sensitive items like:

- Health insurance premiums

- Requirements for health insurance enrollment periods

- Filing income taxes or requesting an extension

- Any real estate taxes

- Utility bills

- Mortgage payments

- Add up your total income—all the money you receive in salary, other payments and benefits and any earnings on investments each year. Divide your annual income by 12 to calculate your monthly income.

- Subtract all your regular monthly bills and the other expenses that you found by keeping track of your spending in your notebook.

- Use a Monthly Budget Template like WISER’s to start this method of tracking your expenses.

- If your income is not covering your expenses, find ways to cut back and reduce your debt. Listing all your expenses will help you think of ways to economize.

- Look at NCOA’s Benefits CheckUp tool to find other ways of supplementing your income or reducing household expenses.

- If you have expensive debt like credit card debt, it is important to figure out a plan for paying it off. This will help your long-term financial future. Read WISER’s page about debt warning signs and what to do about it.

Planning for Medical Expenses

Long-Term Care Insurance is a type of insurance that you can buy to pay for long-term care services your loved one might need:

- daily care and health care services that might allow them to stay in their own home when they are no longer able to do certain things themselves, or

- The resources to choose an assisted living facility or nursing home.

Medicare and Medicaid are public long-term care insurance, but they only cover some care if individuals meet specific requirements. Private long-term care insurance can cover more but must be purchased. Read WISER’s Long-Term Care Insurance post to learn more about this form of insurance.

Older adults can spend a significant amount of money out-of-pocket on necessary prescriptions. But there are different strategies and subsidies to help pay for medication. Visit NCOA’s Prescription Assistance for Caregivers page to review tips on help paying for your spouse’s medication.

Unexpected medical bills are one of Americans’ greatest worries. But surprise medical billing can happen when an out-of-network provider gives your loved one care in an emergency or in a situation where you do not realize the provider is not in-network. AARP has created A Survival Guide to Surprise Medical Bills (also available in Spanish) for caregivers who must take care of surprise billing for their loved ones. Review their tips and resources to deal with big health care bills.